[美元]转:不要低估美元

以下是一篇难道唱多美元的文章

QE不是想象中的印钱

作者疑似Fed的五毛

=====================================================================================================

The US dollar is the currency traders love to hate. "Everybody knows" that the greenback is perpetually weak, a fiat currency made for shorting. This viewpoint is almost inevitably attached to hand-waving notions of money printing vis a vis the Federal Reserve, how America is going down the tubes, and so on.

But this is faulty logic and faulty economics. For one thing, quantitative easing (QE) is not money printing. It is an $85-billion-per-month asset swap, in which one form of bank reserves is switched with another. Having $85B worth of electrons added to the digital ledgers of electronic bank vaults - the 'cash' sitting in those vaults like stagnant pools of water - is not in the same vicinity as printing money directly. It's not the same league, or even the same sport.

So QE itself is not actually inflationary in a "money printing" sense… except in terms of psychological impact on risk asset values. The primary effects of QE are "wealth effect" driven, via the inflation of risk assets as investors grow more aggressive in a central bank dominated, risk-neutered, low return world.

It's possible that QE will eventually prove inflationary above and beyond risk assets, sort of, on an extreme lag basis when banks finally start lending again. But the people who have been predicting QE as inflationary should not get credit for their predictions if inflation does finally turn up on a broad basis.

Why? Because they badly misunderstood the transmission mechanism (it's about monetary velocity, not direct 'printing')… they got the timing spectacularly wrong (inflation was expected years ago, and is still nowhere in sight, other than financial assets)… and if banks start lending vigorously again, they will do so against the backdrop of an improving economy.

There are a lot of huge misconceptions when it comes to macroeconomics. The idea that the US government is "broke" is another one, but we won't delve into that now.

Let's go back to the dollar though, the asset so many love to hate - and short…

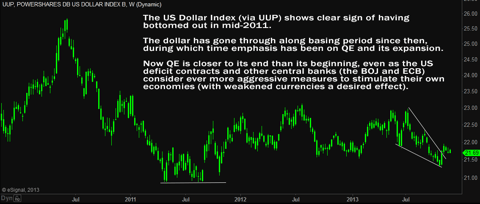

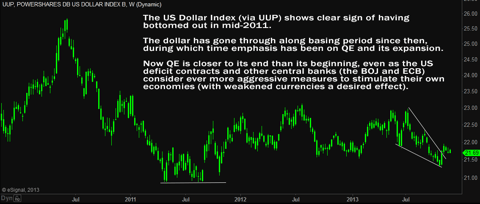

(click to enlarge)

The US dollar (UUP

) shows clear signs of having bottomed out in mid-2011. For nearly all of 2012 and 2013 the USD (as proxied by the US dollar index) has been putting in a massive sideways base. This lines up with multiple macro drivers, all of which disfavored the dollar circa 2011 and are now in the process of transition:

The introduction and embrace of QE highlighted dovish US policy vs. hawkish European policy - which is now shifting. Even as the US Federal Reserve took steps to stimulate via QE and keep interest rates at zero, the European Central Bank (ECB) remained dominated by hawkish Germans who, being Weimar-obsessed, really didn't give a crap if Spain, Greece, et al were put through soft depression conditions via too-tight monetary policy. That dynamic is visibly shifting now, with the Fed sounding more hawkish, and the ECB sounding more dovish, by the day. In the event of a real deflationary global growth threat, the German's objections to ECB action, even a Europe-wide QE, will be overridden.

US investors sent large quantities of capital abroad to invest in emerging market equities and debt - now not so much. The attractiveness of EM assets relative to US assets is a dollar-weakening phenomenon as capital flows away from US shores and into various countries with patterns of fast growth and heavy infrastructure spending. Now, though, emerging markets are in turmoil as "taper talk" gains volume. What's more, some countries (like Brazil) are already showing destructive consumer debt trends (high annual percentage rates, maxed out credit cards) surprisingly early in the cycle. All of this means a general souring of emerging market attractiveness, which means capital repatriating to US shores and again strengthening the USD.

The US deficit is contracting due to forced budget cuts and curtailed government spending. The 'sequester' and other budget restriction measures have led to a falling (contracting) US deficit, which means government spending is falling relative to a broad pickup in economic growth. This is a currency strengthening backdrop, especially in comparison to countries where emergency stimulus spending is likely to accelerate meaningfully (Europe, Japan) in order to avoid the deflationary sand trap.

A low return, slow-growth world favors mature assets and mature companies (like US blue chips), in turn favoring the USD. To the degree that global growth is slowing, emerging market equities become less attractive in light of "hot money" problems, fallout from wasteful infrastructure spending (which only comes to light when things slow down), and backlash from trying to juice economic growth rates (instead of allowing slower, but healthier and more stable, organic rates of growth). As investors adjust to this sea change, they will increasingly favor safety and solidity over sexy returns, which means a migration to blue chips and large US multinationals (which in turn favors the dollar via capital flows).

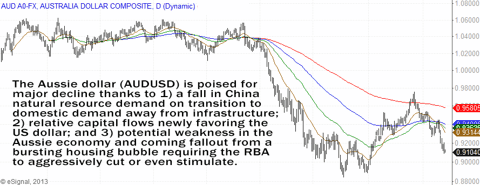

(click to enlarge)

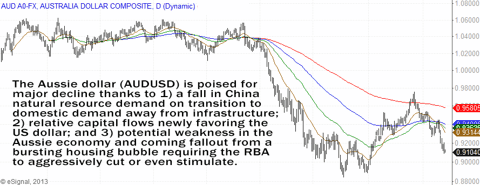

The Australian dollar (AUDUSD) is an example of an excellent shorting opportunity created by a shift in long-term drivers toward US dollar strength. We are short AUDUSD with size (and will pyramid more given the opportunity), with our rationale laid out publicly via Australian dollar could hit low 80s

on October 31st.

We also see substantial opportunity going long dollar / yen (a bet that the Japanese yen will decline), coupled with long Japanese equities.

As the yen depreciates - a development encouraged by the Bank of Japan (BOJ) in the name of positive inflation and getting corporations to spend their cash hordes - Japanese exports become more competitive, the velocity of money increases, and P/E multiples on Japanese stocks expand.

To the degree that the US dollar may be done falling, and setting up for a secular period of strength, that could be a negative for US equities on the whole. The dollar's managed decline in years past, far from being a sign of disaster, was actually a positive for US exports and multinational balance sheets (as profits accrued overseas look bigger when converted back into cheaper dollars). Indeed part of the reason we expect a transition in 2014 is the need for other large players (like Europe and Japan) to embrace the stimulative aspects of cheaper currencies even as the United States, the growth leader of the Western world, makes a net transition to tightening (at least in comparison to others).

But this is faulty logic and faulty economics. For one thing, quantitative easing (QE) is not money printing. It is an $85-billion-per-month asset swap, in which one form of bank reserves is switched with another. Having $85B worth of electrons added to the digital ledgers of electronic bank vaults - the 'cash' sitting in those vaults like stagnant pools of water - is not in the same vicinity as printing money directly. It's not the same league, or even the same sport.

So QE itself is not actually inflationary in a "money printing" sense… except in terms of psychological impact on risk asset values. The primary effects of QE are "wealth effect" driven, via the inflation of risk assets as investors grow more aggressive in a central bank dominated, risk-neutered, low return world.

It's possible that QE will eventually prove inflationary above and beyond risk assets, sort of, on an extreme lag basis when banks finally start lending again. But the people who have been predicting QE as inflationary should not get credit for their predictions if inflation does finally turn up on a broad basis.

Why? Because they badly misunderstood the transmission mechanism (it's about monetary velocity, not direct 'printing')… they got the timing spectacularly wrong (inflation was expected years ago, and is still nowhere in sight, other than financial assets)… and if banks start lending vigorously again, they will do so against the backdrop of an improving economy.

There are a lot of huge misconceptions when it comes to macroeconomics. The idea that the US government is "broke" is another one, but we won't delve into that now.

Let's go back to the dollar though, the asset so many love to hate - and short…

(click to enlarge)

The US dollar (UUP

) shows clear signs of having bottomed out in mid-2011. For nearly all of 2012 and 2013 the USD (as proxied by the US dollar index) has been putting in a massive sideways base. This lines up with multiple macro drivers, all of which disfavored the dollar circa 2011 and are now in the process of transition:

The introduction and embrace of QE highlighted dovish US policy vs. hawkish European policy - which is now shifting. Even as the US Federal Reserve took steps to stimulate via QE and keep interest rates at zero, the European Central Bank (ECB) remained dominated by hawkish Germans who, being Weimar-obsessed, really didn't give a crap if Spain, Greece, et al were put through soft depression conditions via too-tight monetary policy. That dynamic is visibly shifting now, with the Fed sounding more hawkish, and the ECB sounding more dovish, by the day. In the event of a real deflationary global growth threat, the German's objections to ECB action, even a Europe-wide QE, will be overridden.

US investors sent large quantities of capital abroad to invest in emerging market equities and debt - now not so much. The attractiveness of EM assets relative to US assets is a dollar-weakening phenomenon as capital flows away from US shores and into various countries with patterns of fast growth and heavy infrastructure spending. Now, though, emerging markets are in turmoil as "taper talk" gains volume. What's more, some countries (like Brazil) are already showing destructive consumer debt trends (high annual percentage rates, maxed out credit cards) surprisingly early in the cycle. All of this means a general souring of emerging market attractiveness, which means capital repatriating to US shores and again strengthening the USD.

The US deficit is contracting due to forced budget cuts and curtailed government spending. The 'sequester' and other budget restriction measures have led to a falling (contracting) US deficit, which means government spending is falling relative to a broad pickup in economic growth. This is a currency strengthening backdrop, especially in comparison to countries where emergency stimulus spending is likely to accelerate meaningfully (Europe, Japan) in order to avoid the deflationary sand trap.

A low return, slow-growth world favors mature assets and mature companies (like US blue chips), in turn favoring the USD. To the degree that global growth is slowing, emerging market equities become less attractive in light of "hot money" problems, fallout from wasteful infrastructure spending (which only comes to light when things slow down), and backlash from trying to juice economic growth rates (instead of allowing slower, but healthier and more stable, organic rates of growth). As investors adjust to this sea change, they will increasingly favor safety and solidity over sexy returns, which means a migration to blue chips and large US multinationals (which in turn favors the dollar via capital flows).

(click to enlarge)

The Australian dollar (AUDUSD) is an example of an excellent shorting opportunity created by a shift in long-term drivers toward US dollar strength. We are short AUDUSD with size (and will pyramid more given the opportunity), with our rationale laid out publicly via Australian dollar could hit low 80s

on October 31st.

We also see substantial opportunity going long dollar / yen (a bet that the Japanese yen will decline), coupled with long Japanese equities.

As the yen depreciates - a development encouraged by the Bank of Japan (BOJ) in the name of positive inflation and getting corporations to spend their cash hordes - Japanese exports become more competitive, the velocity of money increases, and P/E multiples on Japanese stocks expand.

To the degree that the US dollar may be done falling, and setting up for a secular period of strength, that could be a negative for US equities on the whole. The dollar's managed decline in years past, far from being a sign of disaster, was actually a positive for US exports and multinational balance sheets (as profits accrued overseas look bigger when converted back into cheaper dollars). Indeed part of the reason we expect a transition in 2014 is the need for other large players (like Europe and Japan) to embrace the stimulative aspects of cheaper currencies even as the United States, the growth leader of the Western world, makes a net transition to tightening (at least in comparison to others).

发表于:2013-12-01 23:41只看该作者

5楼